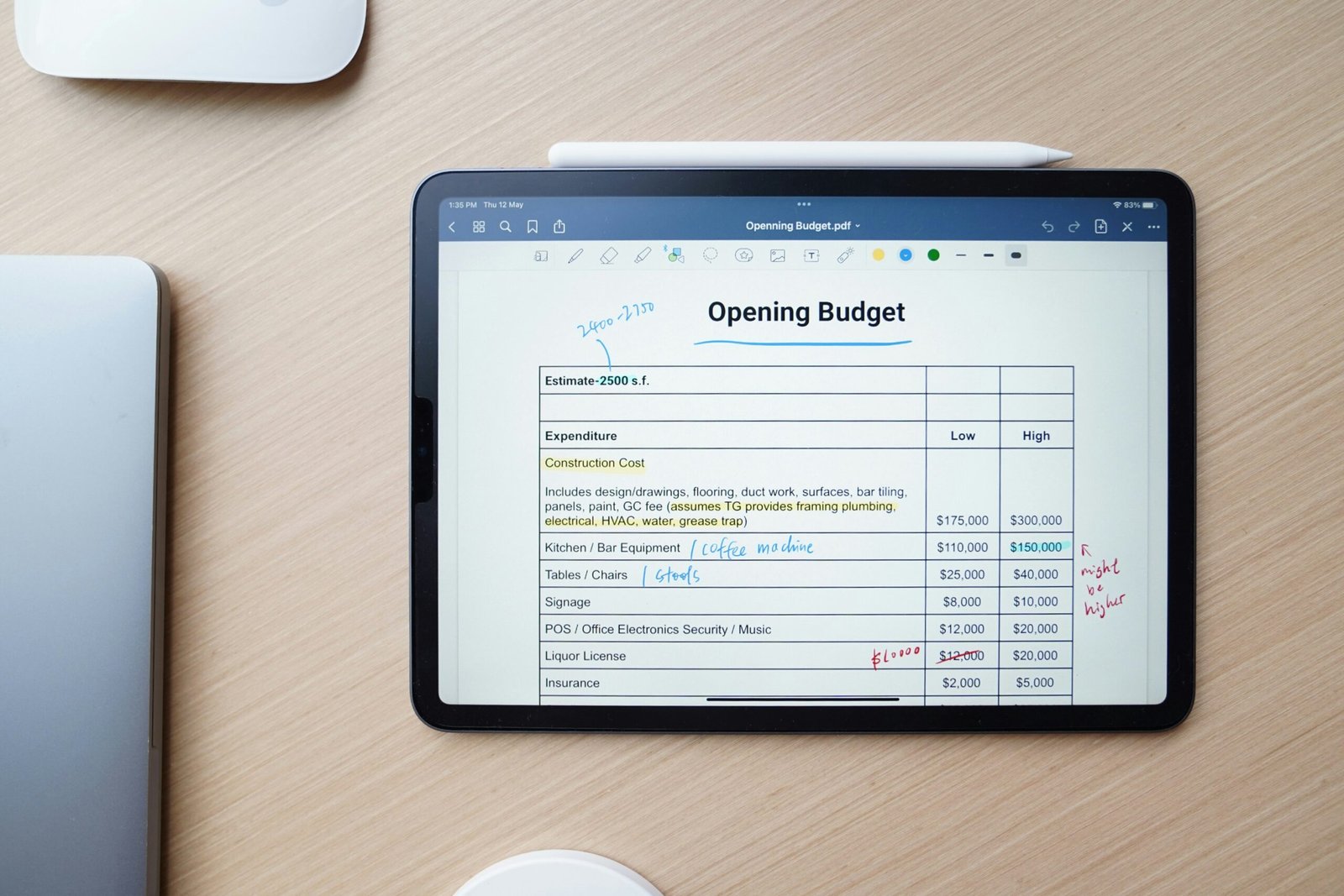

Understanding Your Financial Situation

Before embarking on the journey of budget creation, it is crucial to thoroughly assess your current financial standing. This foundational step provides the necessary insights to ensure your budget is realistic and effective. Begin by gathering all relevant financial information, including your income sources, expenses, debts, and savings. Comprehensive data collection will offer a clear overview of your financial landscape.

To understand your income, document all sources such as salaries, freelance payments, and any alternative income streams. Next, categorize your expenses into fixed costs—like rent or mortgage payments, utilities, and insurance—and variable costs, which may include groceries, dining out, and entertainment. By organizing your financial data this way, you can identify monthly spending patterns and evaluate your financial health.

In addition to expenses, it is essential to consider any debts, such as credit card balances or student loans. Calculate the total amount owed and the interest rates associated with those debts to prioritize repayment strategies effectively. Simultaneously, take stock of your savings, noting how much you have and the goals tied to each savings account or investment.

Once you have gathered and categorized this financial information, analyze your spending habits by tracking your transactions over a month. This exercise can reveal unnecessary expenditures and provide an opportunity to cut back on non-essential items. Observe your patterns of spending and identify areas where adjustments can be made. For example, frequent dining out may be a habit that can be replaced with cooking at home, ultimately enhancing your budgetary flexibility.

By understanding and evaluating your financial situation, you create a strong foundation for the budgeting process. This clarity will facilitate informed decision-making as you move forward in establishing a budget that effectively meets your financial goals.

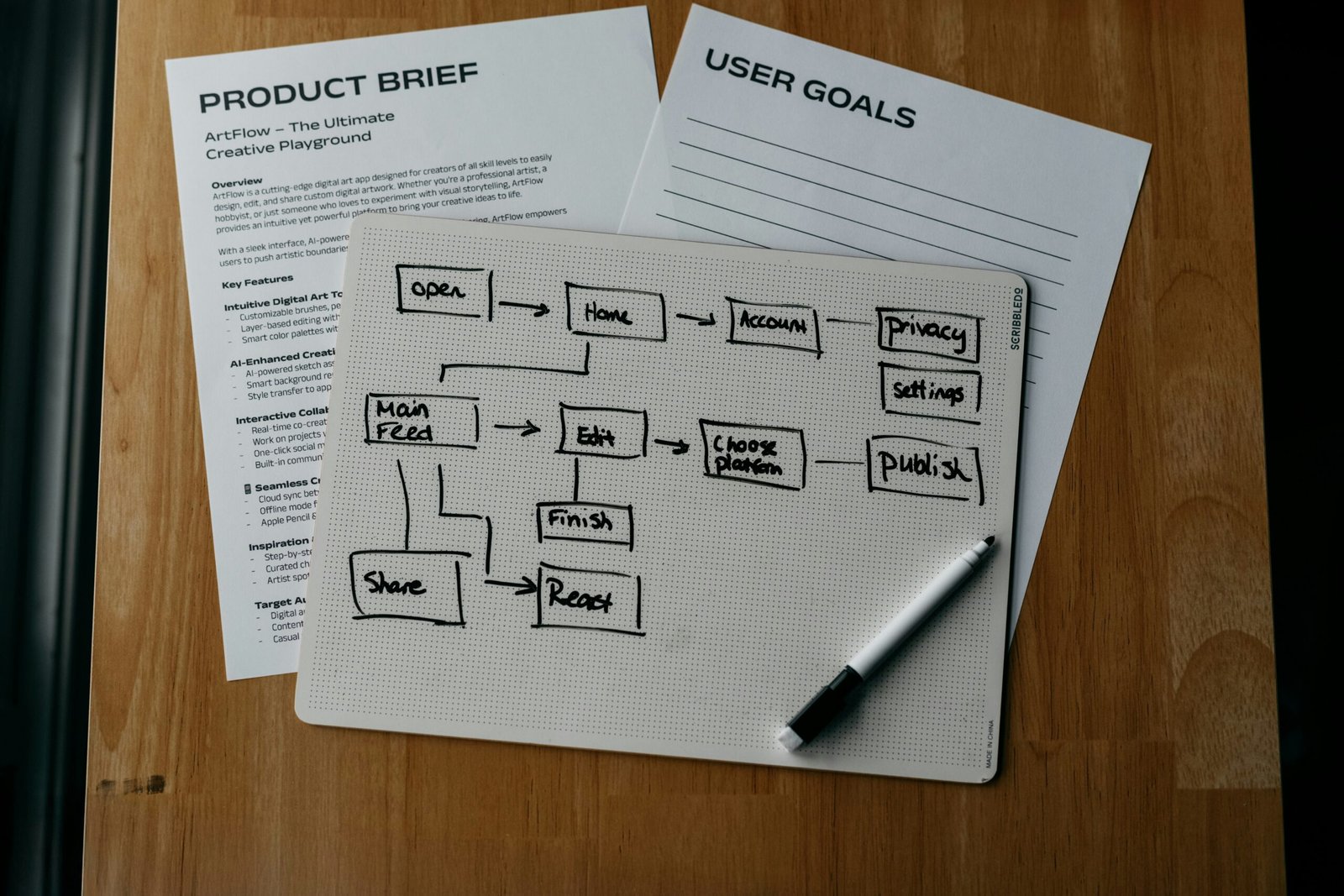

Setting Clear Financial Goals

Establishing clear financial goals is a pivotal step in creating a budget that effectively serves your needs. Financial goals should adhere to the SMART criteria—specific, measurable, achievable, relevant, and time-bound. This methodology ensures that the objectives you set are not only well-defined but also practical and attainable within a specified timeframe.

When differentiating between short-term and long-term goals, it is essential to recognize their distinct purposes. Short-term goals typically span a period of one year or less and may include saving for a vacation, buying new appliances, or paying off small debts. In contrast, long-term goals are generally set for a horizon of several years, potentially encompassing aspirations such as saving for retirement, purchasing a home, or funding education for children. Prioritizing these goals is crucial; for instance, urgent needs should take precedence over long-term aspirations.

Aligning your financial objectives with your personal values and aspirations can significantly enhance your commitment to achieving them. Reflect on what is truly important to you—whether it’s financial independence, travel experiences, or providing for your family. By directly connecting your financial goals to your core values, you create a more compelling motivation to adhere to your budget.

To maintain motivation throughout the budgeting process, employ techniques such as tracking progress and celebrating small milestones. Regularly reviewing your financial goals can help identify any adjustments needed as circumstances change. Real-life examples of successful financial goals can serve as inspiration; for instance, individuals who have saved diligently for a down payment on a house often cite their goal as a pivotal motivator. Through careful planning and dedication, you can create a budget that helps you achieve your financial objectives and cultivate a sense of accomplishment.

Creating and Maintaining Your Budget

Creating a budget that aligns with your unique financial situation and goals is essential for achieving financial stability. The initial step in this process involves identifying your income sources and tracking your expenses. Once you have a clear understanding of your financial landscape, you can select a budgeting method that suits you best. Three popular budgeting techniques are the 50/30/20 rule, zero-based budgeting, and the envelope system.

The 50/30/20 rule is uncomplicated and focuses on dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This method promotes a balanced approach, allowing for both essential spending and leisure activities while ensuring you save adequately for future needs.

On the other hand, zero-based budgeting requires you to allocate every dollar of your income to expenses, savings, and debt repayment until you reach a “zero balance.” This meticulous approach helps you scrutinize your spending habits and can lead to more deliberate financial choices. Lastly, the envelope system involves using cash for various spending categories, which can be helpful in preventing overspending.

After establishing your chosen budgeting method, it is important to integrate strategies for maintaining discipline and flexibility. Setting aside time each week or month to review your budget can help you stick to your financial goals. Additionally, be prepared to make adjustments as your financial circumstances change. Whether you’re dealing with unexpected expenses or receiving a bonus, reassessing your budget regularly ensures it remains an effective tool for managing your finances.

Ultimately, staying committed to your budgeting journey will significantly enhance your financial wellbeing. By routinely revisiting your budget, you can adapt it according to new priorities, evolving needs, and unforeseen events, fostering a sense of control over your financial future.